Main Menu

Main Menu

Managing cash flow, preparing accurate reports, and reimbursing staff expenses… for sure, these tasks weren’t what you had in mind when you established a nonprofit. And as a founder, doing these things could be challenging and overwhelming – but, they should be done. After all, even if making a sale is not a priority, a nonprofit organization is still a business.

We totally understand if you’ve fallen behind in your books and other accounting duties, that’s why we’re here to help. From bookkeeping, and reporting, to taking care of payroll, our team of number crunchers are here to deliver financial services distinct to nonprofit organizations.

Let us support you with your bookkeeping needs so you can move forward with your mission and make a difference.

As a founder, it’s your main duty to carry out the mission of your nonprofit organization. However, it’s also your responsibility to oversee, and in most cases, take care of other essential tasks like bookkeeping.

Is it possible for you to do DIY nonprofit bookkeeping? A straight answer would be – yes. BUT, with so many things you should take care of, it wouldn’t be a surprise if you find yourself struggling to keep your books updated.

A few reasons why DIY bookkeeping for your nonprofit is a bad idea:

As you would expect, nonprofit organizations have a distinct set of financial requirements and terminologies that are not applicable to for-profit businesses. For example, a for-profit company uses a balance sheet to report the available assets, current liabilities and shareholder equity. A nonprofit, on the other hand, uses a statement of financial position, which calculates the overall assets it has on hand and the availability of these assets for future services.

Another example is that for-profit businesses maintain a general ledger, while nonprofits have several ledgers to track numerous funds. These funds are individually balanced and the organization’s financial reports should show a summary of the expenses and revenues in each fund.

With nonprofit bookkeeping, it is different from traditional bookkeeping. You would surely benefit from hiring professionals who have the knowledge and expertise on how to properly deal with your books.

Find nonprofit bookkeepers at miplly.

Although you can find volunteers to fill in key roles in your organization, important tasks, such as bookkeeping, are best handled by experienced professionals.

Accountability and integrity are paramount in any nonprofit, which gives you more reasons to only trust someone who knows what they’re doing. When you engage with a nonprofit bookkeeper you can expect the following:

As required by the law, you should keep track of not only monetary donations but also other types of contributions, such as services provided to you or items that were purchased by donors on behalf of your nonprofit. A bookkeeper will help you put a system in place to properly record all types of contributions.

Running payroll for a nonprofit organization isn’t a walk in the park since you deal with volunteers, contractors, and employees. Luckily, you can rely on a bookkeeper to navigate through these challenges and ensure that your funds are utilized when it comes to paying your team.

Every organization, including your nonprofit, should have controls in place to protect it from fraud. One step to do this is to have some internal bookkeeping policies and controls, which an experienced professional can assist you to establish.

Do you still keep a shoebox to keep receipts? Utilizing software that’s specially designed for nonprofits, will make your life a lot easier.

A bookkeeper will help you determine which solutions available are the best to fit your needs. They will even help you arrange your account so you can integrate other tools for a more seamless bookkeeping and accounting process.

A reliable bookkeeper will make sure that all data is present and well accounted for. With updated records, you can easily generate financial statements, whenever you need them, to share with board members.

Sure, nonprofits have tax-exempt status, but charitable organizations still have to comply with some requirements from the IRS such as filing a 990 each year to maintain this status. A bookkeeper can file this form for you, plus they will also notify you if you have other taxes that you have to report to the IRS.

Like any other entity, the needs of nonprofit organizations vary. That’s why here at miplly, we structured our bookkeeping packages to meet your current needs.

Our starter offer begins at $175, which includes a personal bookkeeper, financial overview, account reconciliation, daily balances, and monthly reports. You can also scale and customize our services based on what you require.

Professional nonprofit bookkeeping services for your unique bookkeeping needs.

For most founders running a nonprofit, keeping their books updated could be the least of their concerns – but this is something that you shouldn’t neglect.

Start working with miplly and we’ll provide you with reliable bookkeeping services and sound financial reports. With these things in place, you’ll have improved transparency, confidence in making decisions, and more hours added to your pursuing your organization’s mission.

Get in touch with our team today!

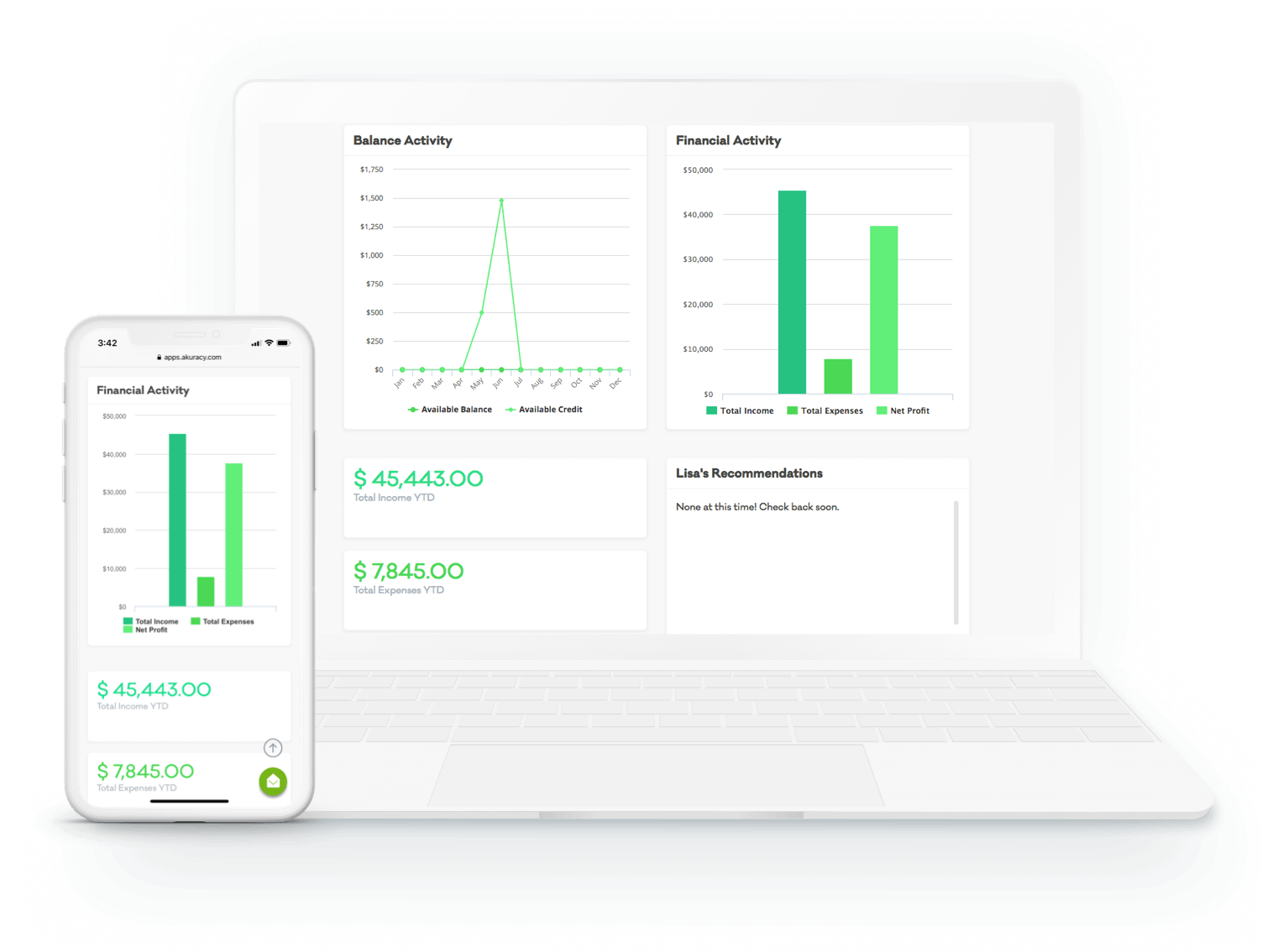

Use the reporting tab in the menu on your dashboard to see your monthly, quarterly and yearly financial reports.

We specialize in helping businesses achieve financial freedom through strategic tax solutions. Our expert team navigates complex tax laws, minimizes tax liabilities, and maximizes returns. Trust us for reliable and results-driven tax & accounting services that put you on the path to success.